Out Of This World Info About How To Lower Apr On Credit Cards

Balance transfer as an alternative to a lower rate, for credit cardholders facing carried balances with high interest rates, a balance transfer card option may help reduce a rate.

How to lower apr on credit cards. Easily compare 2022's best debt consolidation services. Ask them to transfer the call to a supervisor. Easily compare & apply online.

Your credit card company won't lower your apr just because you've been taking care of your credit; Many people in troubled situations may inquire about closing their accounts altogether because it is too expensive to maintain. Our experts found the best credit card offers for you!

If you have a few credit cards, talking to the creditor you’ve had an account with the longest is a smart idea. Apr stands for annual percentage rate. You must be proactive and contact them to ask for a rate reduction.

Get 0% intro apr up to 21 months & enjoy interest free payments until 2024. Learn more & apply today. Get started in 5 mins.

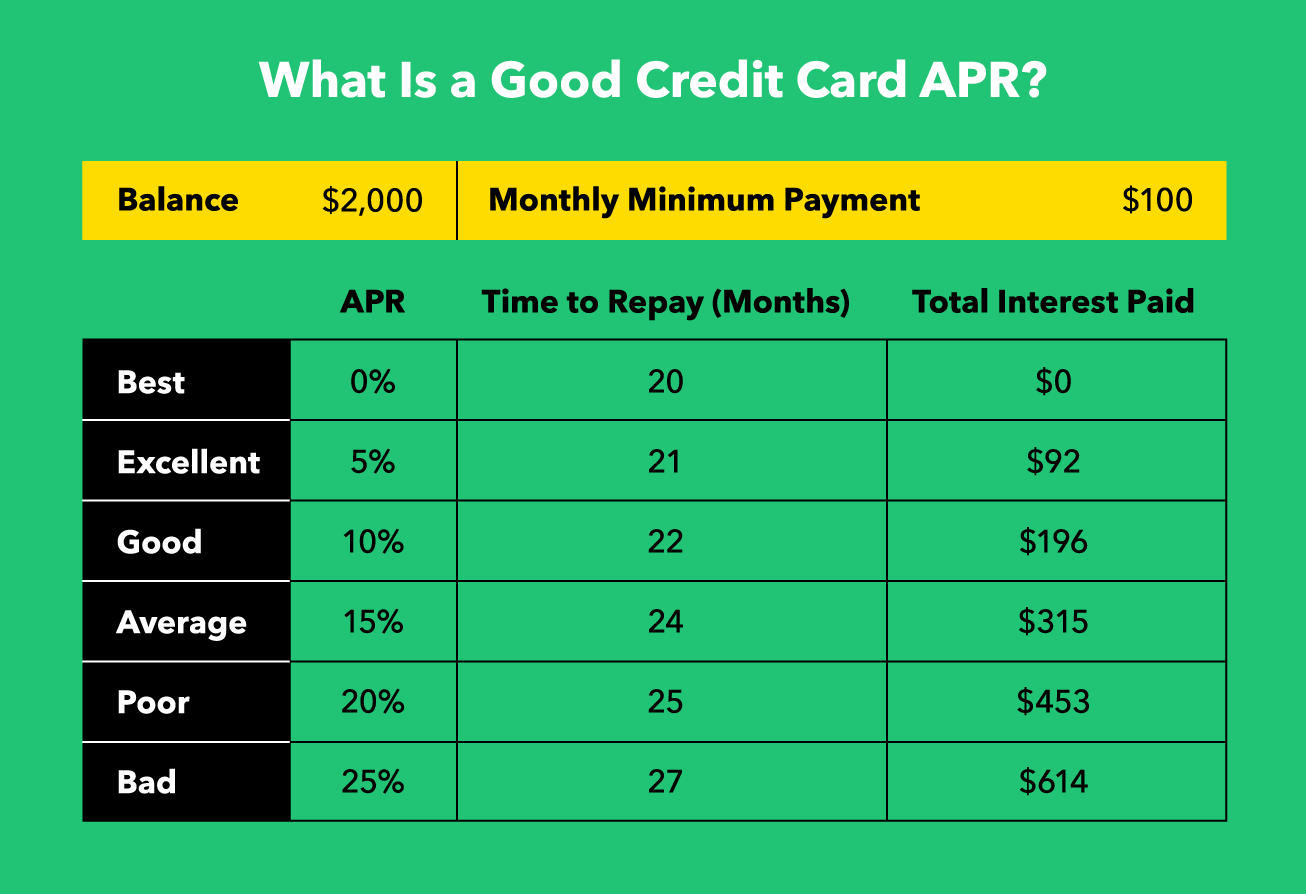

An improvement in your credit score is critical if you want to start reducing the apr. Get a card with 0% apr until 2024. Ad browse these card categories:

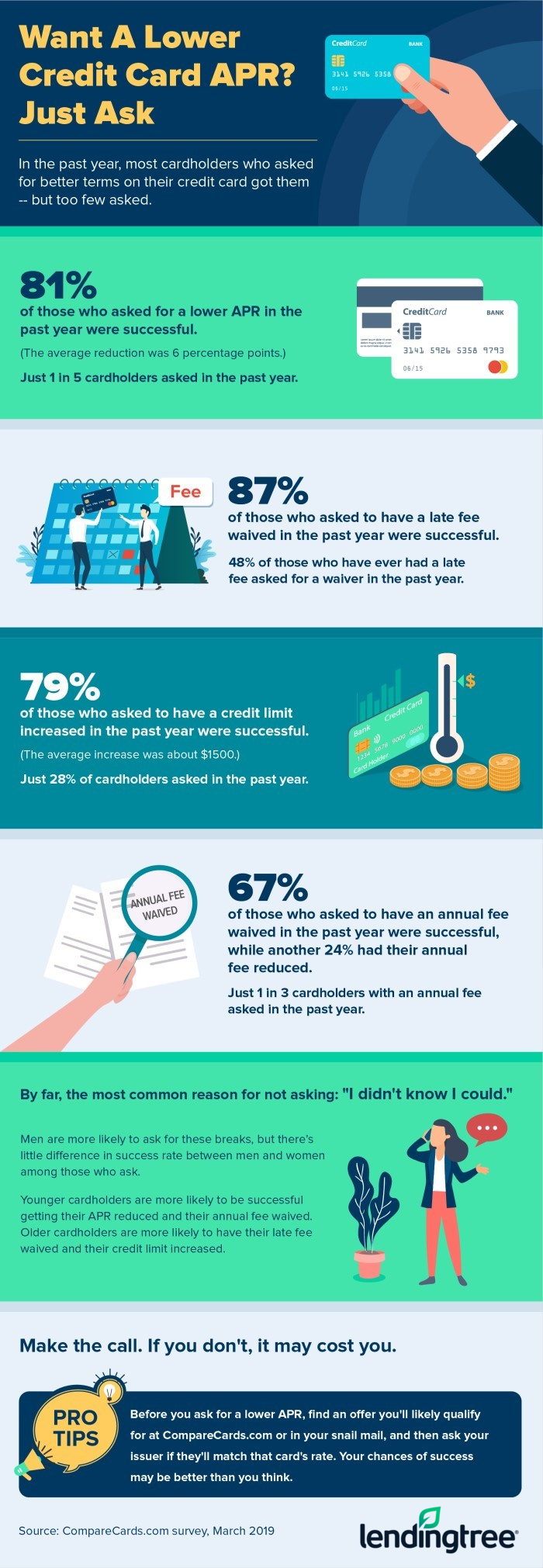

Ad see offers like $200 cash bonus & up to 5% cash back on purchases. Cut debt by 50% or more. Here are four steps you could take to negotiate a lower interest rate.