Favorite Tips About How To Reduce Monthly Credit Card Payments

Compare top 5 companies ready to help!

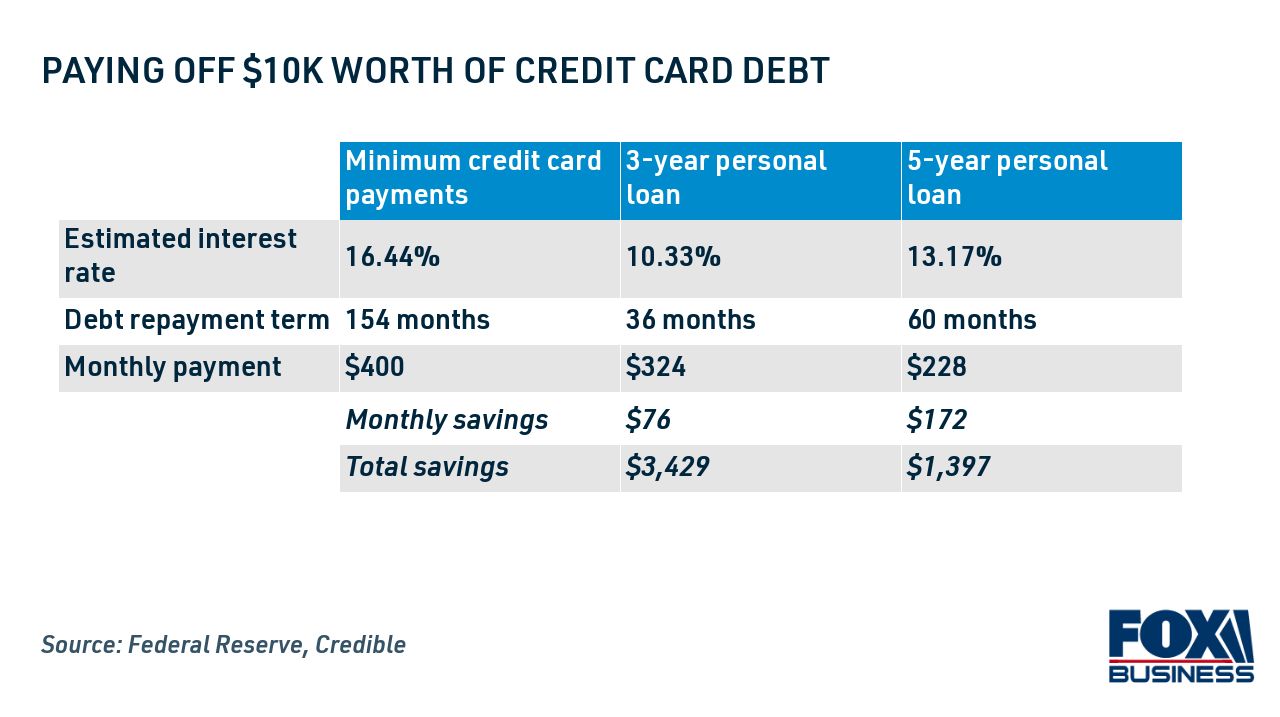

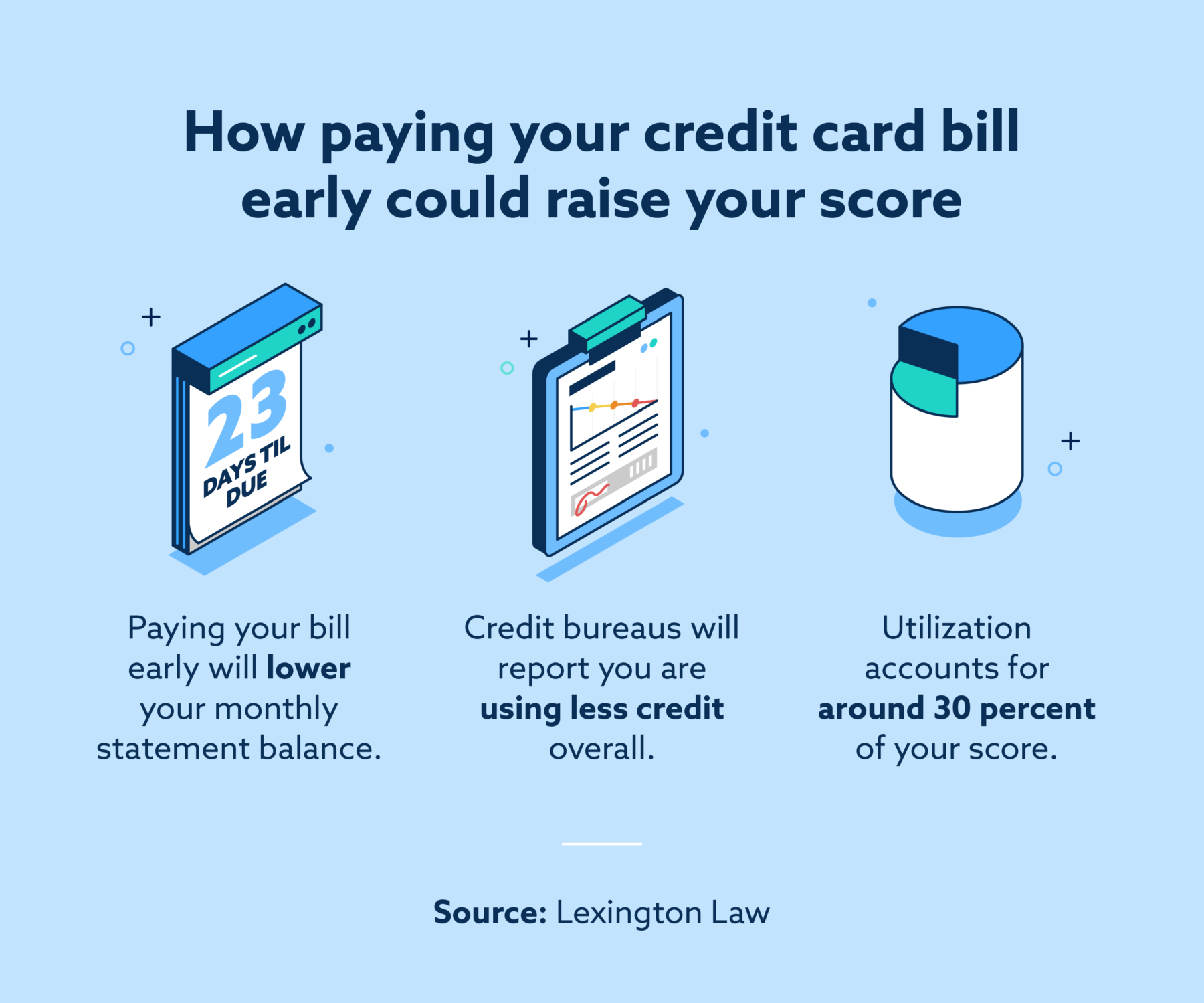

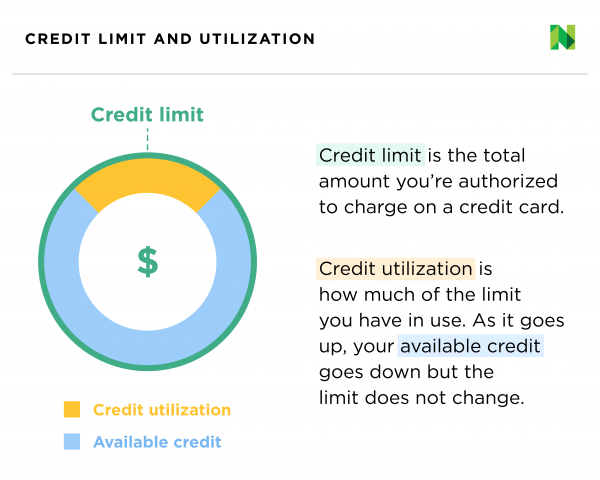

How to reduce monthly credit card payments. Use a balance transfer credit card to refinance. Always pay off your credit card balance in full each month. How to get lower credit card payments one way to lower your credit card bill is to consolidate the payments for each of your credit accounts into a single monthly.

If you have credit card debt on multiple cards, some personal. According to experian, millennials have an average of 2.5 cards each, while baby boomers average 3.5. Check your eligibility to see if you qualify for lower payments.

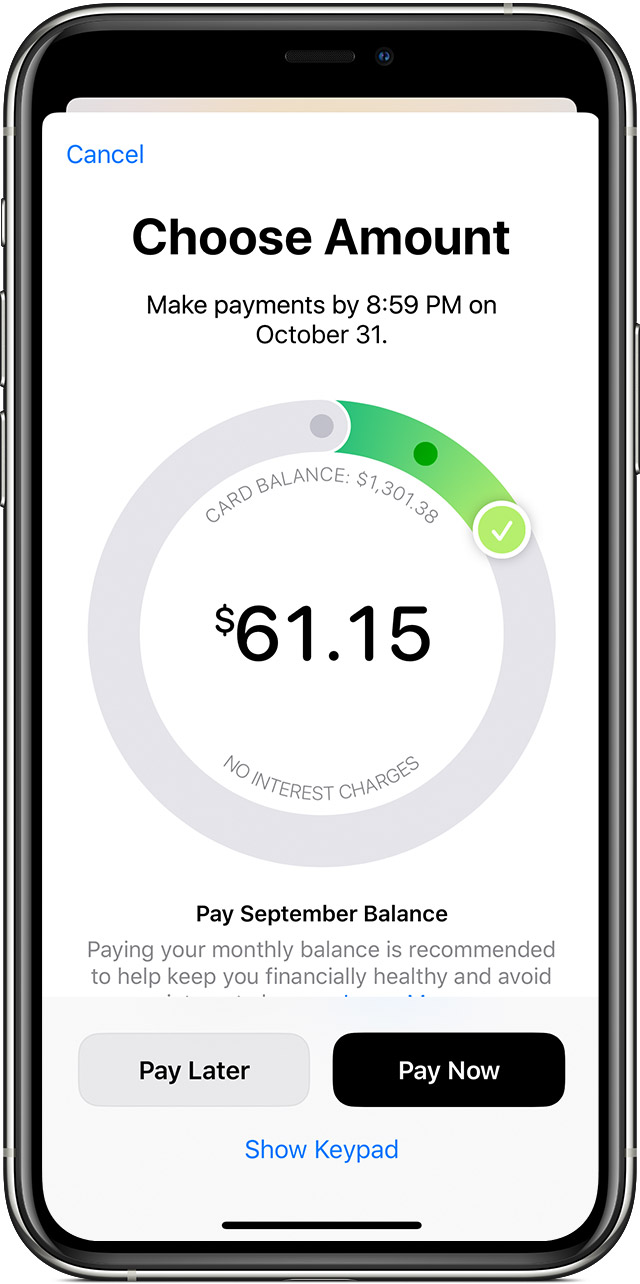

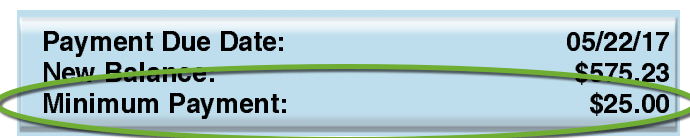

Customers have two main options when negotiating. But making more than the minimum payment can lower your. Make easy payments by transferring funds from one of your 1st ed deposit accounts.

Pay off your cards in order of their interest rates. Here are 10 tips for reducing credit card debt in 2014: As you pay off more and more of the principal amount on each.

You have many options when paying your credit card, like making only the minimum payment or paying extra. Ad we've rated the best options for getting out of debt. The following are some methods for avoiding credit card interest:

So, if you have a. Paying down your credit card balance is the best way to lower your minimum payment. Four $50 payments or two $100 payments are sometimes easier to make than a.